Our philosophy is simple. We want to get to know you in order to help you make the best decisions possible.

RF&L believes in modern portfolio theory and uses its principles as we manage investments for clients. While many advisors are focused on beating the market, we are focused on leveraging the power of the market. As such we are passive investors and believe that academic research is clear that over the long-term, investors are appropriately rewarded for the amount of risk they take in their portfolios. We help you identify that appropriate level based on your individual situation.

We firmly believe that utilizing low fee funds, managing transaction costs, and minimizing taxes are all vital components to helping clients achieve their financial goals. We are not stock pickers and have no crystal ball indicating which assets will outperform next quarter.

Based on our interpretation of the latest academic research, we design diversified portfolios and help frame the critical asset allocation questions based on your personal risk tolerance and profile:

- How much should I invest in equities vs. fixed income?

- Should I invest in funds or individual securities?

- What is the appropriate domestic vs. international asset allocation?

- Should I invest in large-cap or small-cap companies?

- What is the appropriate allocation across growth vs. value?

- How should I allocate my fixed income investments across the duration and credit quality spectrums?

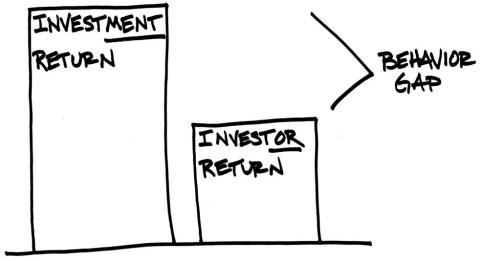

These answers are rarely the same for any two clients. Regardless of the client we stress patience, diversification, and a long-term focus.

Photo Source: behaviorgap.com